Montreal, February 09, 2022 – Geomega Resources Inc. (“Geomega” or the “Corporation”) (TSX.V: GMA) (OTC: GOMRF), a developer of clean technologies for the mining, refining and recycling of rare earths, is pleased to announce the continuation of hydrometallurgical test work on its Montviel rare earths deposit. The work will be done by Innord, the 100% owned subsidiary of Geomega, with a $400,000 funding contribution from the Ministère de l’Énergie et des Ressources Naturelles (MERN) of Quebec. To complement the working budget for this project, Geomega closed a non-brokered private placement (the “Offering”) of 1,408,055 units (the “Units”), at a price of $0.27 per Unit, for aggregate gross proceeds in the amount of $380,175 with Quebec based institutional investors, including the Société de développement de la Baie James (SDBJ), and insiders of the Corporation. This will allow the Corporation to have a dedicated budget for this project, independent of the budget allocated for the construction of the rare earth magnets recycling plant in St-Bruno, which is progressing towards equipment ordering, and other R&D projects.

“The Montviel project is one of the most promising rare earth projects in North America. It’s got the size and the infrastructure required for an economic project however, we wanted to confirm that the project would have robust full cycle economics in all commodity price environments. As our technology has continued to evolve and improve over the last 7 years, we are now in a position to be able to start applying our technology and IP developments to the Montviel flow sheet. Our main goal is to deliver an economically and environmentally robust rare earths project in the province of Quebec that can sustain the price swings that we have seen over the last 10+ years in the rare earths market. We believe that the proposed hydrometallurgical improvements will make Montviel a rare earths project that could operate profitably even at the lowest REE prices that we saw as recently as 2019, and on the contrary, make it an extremely profitable and valuable project at the current REE prices, which have seen an increase of 300% in the last 24 months.” commented Kiril Mugerman, President & CEO of Geomega.

Montviel Hydrometallurgy Project

The project will be conducted under the “Program to support the exploration of critical and strategic minerals in Quebec” offered by the MERN. The 12 to 24-months project has a budget of $865,324 out of which the government grant program will contribute $400,000 of non-dilutive funding to the Corporation. The objective of the project is to improve on the technology that was developed and patented in 2015 (see news releases from April 29, 2015, May 20, 2015 and June 11, 2020) by incorporating the knowledge and experience gained from developing the rare earth recycling project and the bauxite residues project since then.

The main technical objectives to be investigated in this project are:

• Eliminating the flotation circuit

• Valorization of the iron by-product

• Recycling of the main leaching reagents

The successful implementation of these objectives would simplify the process of extracting rare earths and niobium and could significantly reduce its operating costs. The economic benefits of this project include:

• Cost reduction of the chemical reagents

• Energy savings by avoiding very fine grinding that is required for flotation, solid heat recovery and other adjustments

• Improving total REE recovery through whole ore leaching

• Reduction of mining waste and tailings management costs

• Increase of potential revenues through various by-products

Furthermore, the social and environmental impacts of the project are similarly important and will help obtain the required permits in the future and support of the local communities and the Waswanipi CREE First Nation. The environmental benefits of this project include:

• Reduction of water consumption

• Reduction of liquid effluents

• Reduction of solid mining waste volumes

• Reduction of overall energy consumption and greenhouse gas emissions for REE production compared to previous flowsheet

• Further evaluation of the possibility of paste-backfill

The results of the project will be used to complete a Preliminary Economic Assessment (PEA) on the Montviel deposit.

“The PEA that will follow once this hydrometallurgical test work is completed successfully, should confirm our technological advancements and their economical benefits and set the stage for the next steps in Montviel rare earth project development.” continued Mugerman. “The potential enhanced economics from the metallurgical improvements at Montviel coupled with a much stronger and sustainable demand for neodymium and praseodymium, which together account for 21% of the Total REO at the deposit, position Geomega well for a potentially robust economic proposition at Montviel going forward. Furthermore, being able to leverage revenues from the rare earth magnets recycling plant in St-Bruno and our technical expertise will help avoid unnecessary dilution for our shareholders.”

Private Placement

The Offering of Units consists of one common share (each a “Share”) and one-half of one share purchase

warrant (each whole warrant, a “Warrant”). Each Warrant entitles the holder thereof to acquire one additional

Share at a price of $0.40 per Share until the date that is 24 months from their issue. The securities issued under the Offering have a hold period of four months and one day from their issue. The Offering is subject to final

acceptance of the TSX Venture Exchange.

“We are very grateful to the MERN and the Quebec based institutional investors who are helping us fund this

project today. Quebec once again leads by example, setting clear goals for critical and strategic minerals and

then supporting that through funding. Your support and belief in the Montviel deposit is noted and our technical

team will work hard to make rare earth mining in Quebec a reality.” added Mugerman.

Certain members of the board, being Gilles Gingras and Nicholas Nickoletopoulos, as well as Mathieu Bourdeau,

Chief Financial Officer, have participated in the closing of the Offering in the aggregate amount of $26,190 (the

“Insiders’ Participation”). The Insiders’ Participation is considered a “related party transaction” under

Regulation 61-101 respecting Protection of Minority Security Holders in Special Transactions (Québec)

(“Regulation 61-101”) and the corresponding Policy 5.9 of the TSXV; however, the Insiders’ Participation is

exempt from the formal valuation and minority shareholder approval requirements provided under Regulation

61-101 in accordance with sections 5.5(a) and 5.7(1)(a) of said Regulation 61-101. The exemption is based on

the fact that neither the market value of the Insiders’ Participation nor the consideration paid therefor exceeds

25% of the Corporation’s market capitalization. The Corporation did not file a material change report at least 21

days prior to the closing of the Offering since the Insiders’ Participation was not determined at that moment

and the Corporation wished to close the Offering on an expedited basis for sound business reasons.

About Montviel

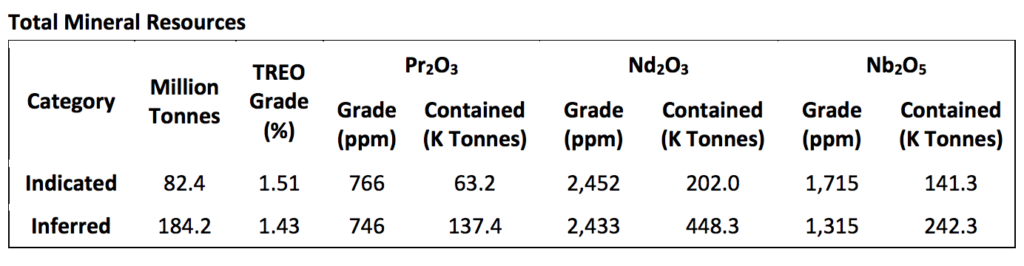

Geomega announced an updated National Instrument 43-101 compliant mineral resource estimate on its 100%

owned Montviel REE and niobium project on June 17, 2015. The entire report is available here and on the

Corporation website. Highlights of the Resource Estimate are presented below:

• Mineral resources are estimated and reported in compliance with NI 43-101

• Mineral resources are not mineral reserves and do not have demonstrated economic viability

• Other disclosures and assumptions can be seen in the above press release (June 17, 2015) and in the complete document on the Corporation website

NI 43-101 Disclosure

Alain Cayer, P. Geo., M.Sc., Vice-President Exploration of Geomega, is the Qualified Person under NI 43-101 guidelines who supervised and approved the preparation of the technical information in this news release.

Change of Auditors

The Corporation also announces it has changed its auditors from PricewaterhouseCoopers LLP (“Former

Auditor“) to MNP LLP (“Successor Auditor“) effective January 20, 2022.

There were no reservations in the Former Auditor’s audit reports for any financial period during which the

Former Auditor was the Corporation’s auditor. There are no “reportable events” (as the term is defined in

National Instrument 51-102 – Continuous Disclosure Obligations) between the Corporation and the Former

Auditor.

In accordance with National Instrument 51-102, the Notice of Change of Auditor, together with the required

letters from the Former Auditor and the Successor Auditor, have been reviewed by the Corporation’s Audit

Committee and filed on SEDAR accordingly.

About Geomega (www.geomega.ca)

Geomega develops innovative technologies for extraction and separation of rare earth elements and other critical metals essential for a sustainable future. With a focus on renewable energies, vehicle electrification, automation and reduction in energy usage, rare earth magnets or neo-magnets (NdFeB) are at the center of all these technologies. Geomega’s strategy revolves around gradually de-risking its innovative technology and delivering cashflow and return value to shareholders while working directly with the main players in these industries to recycle the magnets that power all those technologies.

As its technologies are demonstrated on larger scales, Geomega is committed to work with major partners to help extract value from mining feeds, tailings and other industrial residues which contain rare earths and other critical metals. Irrespective of the metal or the source, Geomega adopts a consistent approach to reduce the environmental impact and to contribute to lowering greenhouse gases emissions through recycling the major reagents in the process.

Geomega’s core project is based around the ISR Technology (Innord’s Separation of Rare Earths), a proprietary, low-cost, environmentally friendly way to tap into a C$1.5 billion global market to recycle magnet production waste and end of life magnets profitably and safely.

Geomega also owns the Montviel rare earth carbonatite deposit, the largest 43-101 bastnaesite resource estimate in North America and holds over 16.8M shares, representing approximately 16% of the issued and outstanding shares, of Kintavar Exploration Inc. (KTR.V), a mineral exploration company that is exploring for copper projects in Quebec, Canada.

About SDBJ

SDBJ was created under the James Bay Region Development Act adopted by the Québec National Assembly in 1971. Its mission is to promote, from a sustainable development perspective, the economic development, improvement and exploitation of natural resources other than hydroelectric resources falling within Hydro Québec’s mandate in the Baie James territory. SDBJ can also foster, support and participate in the implementation of projects having these objectives.

For further information, please contact:

Kiril Mugerman

President and CEO

Geomega

450-641-5119 ext.5653

kmugerman@geomega.ca

Nancy Thompson

Vorticom Public Relations

212-532-2208

nancyt@vorticom.com

Twitter: @Geomega_REE

Cautions Regarding Forward-Looking Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains statements that may constitute “forward-looking information” or “forward-looking statements” within the meaning of applicable Canadian securities legislation. Forward-looking information and statements may include, among others, statements regarding future plans, costs, objectives or performance of the Corporation, or the assumptions underlying any of the foregoing. In this news release, words such as “may”, “would”, “could”, “will”, “likely”, “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate” “target” and similar words and the negative form thereof are used to identify forward-looking statements. Forward-looking statements should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether, or the times at or by which, such future performance will be achieved. No assurance can be given that any events anticipated by the forward-looking information will transpire or occur, including as regards the commercialization of any of the technology referred to above, or if any of them do so, what benefits the Corporation will derive. Forward-looking statements and information are based on information available at the time and/or management’s good-faith belief with respect to future events and are subject to known or unknown risks, uncertainties, assumptions and other unpredictable factors, many of which are beyond the Corporation’s control. These risks, uncertainties and assumptions include, but are not limited to, those described under “Risk Factors” in the Corporation’s annual management’s discussion and analysis for the fiscal year ended May 31, 2021, which is available on SEDAR at www.sedar.com; they could cause actual events or results to differ materially from those projected in any forward-looking statements. The Corporation does not intend, nor does the Corporation undertake any obligation, to update or revise any forward-looking information or statements contained in this news release to reflect subsequent information, events or circumstances or otherwise, except if required by applicable laws.