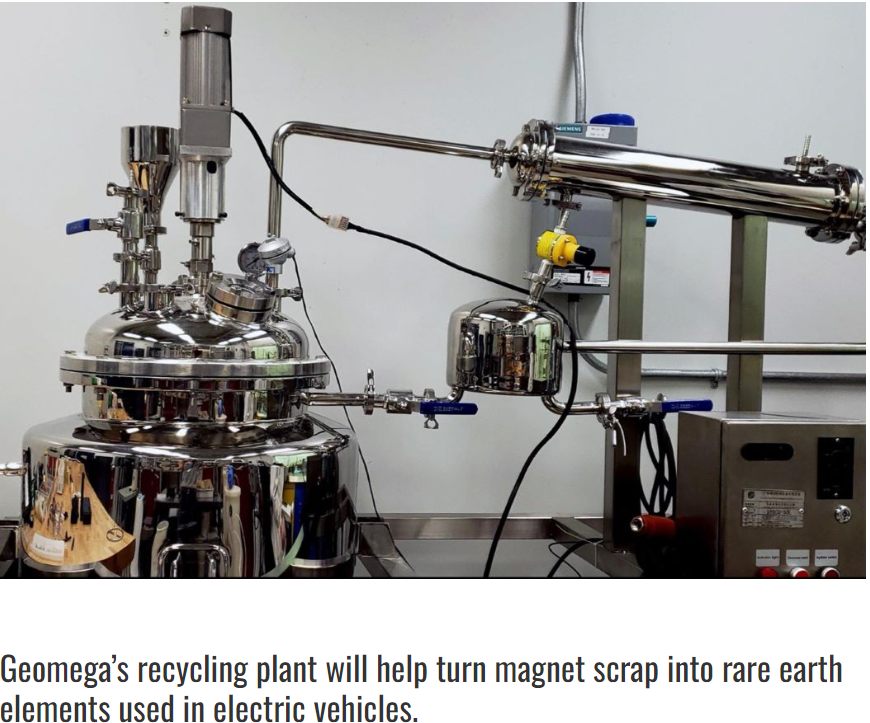

Geomega Resources (TSXV: GMA), a rare earth clean technologies developer, and USA Rare Earth, the funding and development partner of the Round Top heavy rare earth project in Texas, announced Thursday that they have entered into a letter of intent (LOI) to recycle rare earth-containing production waste from USA Rare Earth’s future production of sintered neodymium iron boron permanent magnets.

The $14 billion-a-year rare earth magnet market is more than 60% controlled by China which, under Made in China 2025, is increasingly using rare earth magnets in finished and semi-finished products, as opposed to exporting the magnets, and industry sources estimate the rare earth magnet market will nearly double by 2027.