Montreal, February 23, 2023 – Geomega Resources Inc. (“Geomega” or the “Corporation”) (TSX.V: GMA) (OTC: GOMRF), a developer of clean technologies for the mining, refining, and recycling of rare earths and other critical materials, is pleased to announce that it has executed a binding option agreement (the “Option Agreement”) to sell a 100% interest in the Pomme REE project (“Pomme”) to Mt Monger Resources Limited (ASX:MTM, Mt Monger).

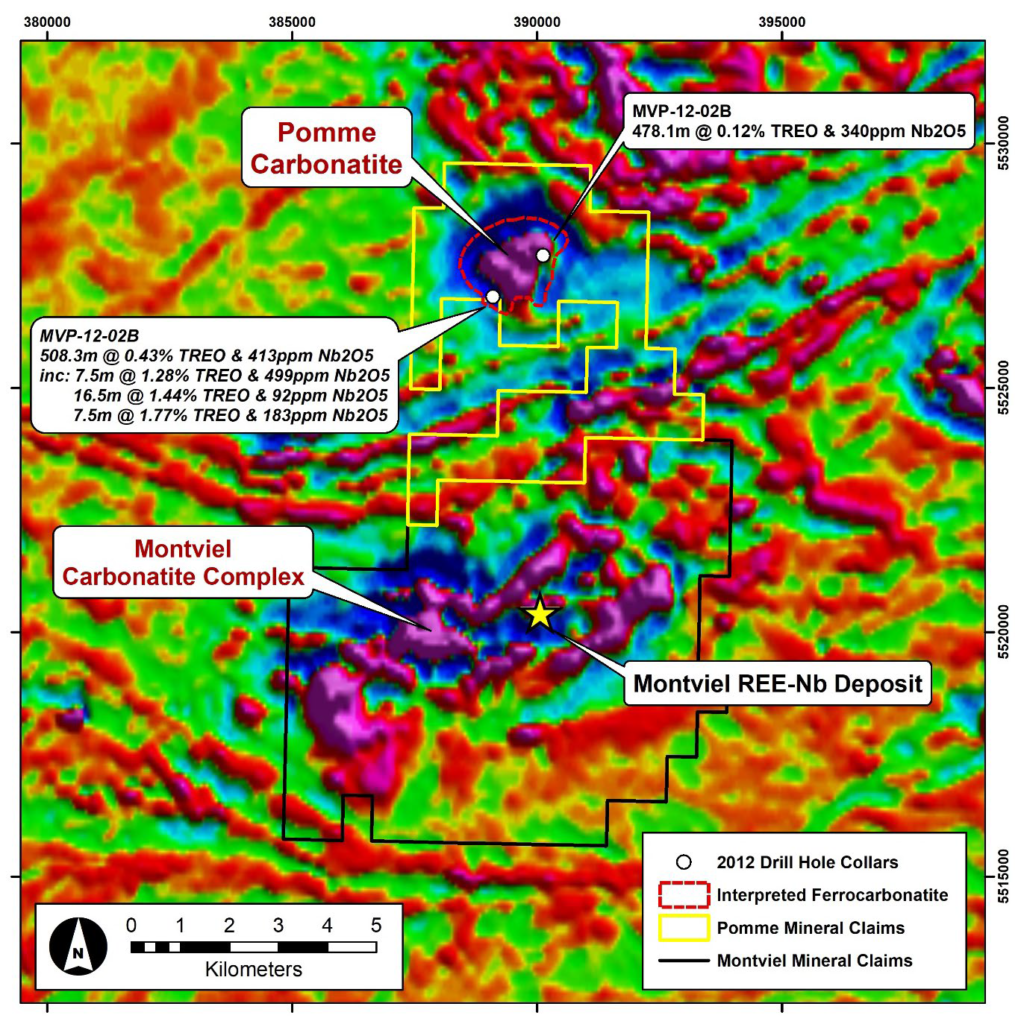

The Pomme project is located adjacent to the North of the world-class Montviel REE-Nb deposit (wholly owned by Geomega) (Figure 1) that was discovered by Geomega in 2011 and has a defined total indicated and inferred resource of 266 Mt @ 1.45% TREO and 0.14% Nb2O5. Geomega has completed 2 exploration drill holes on the Pomme project in 2012 and both have returned significant rare earth intercepts of 478.1m @ 0.12% TREO and 508.3m @ 0.43% TREO. All exploration work since then has focused on the Montviel Carbonatite complex. Figure 1 shows the location of the Pomme project relative to the Montviel project and the location of the drill holes. More details about the transaction and the Pomme project can be found in the Mt Monger press release.

As per the Option Agreement, Mt. Monger will have 3 years to earn 100% interest in the Pomme property as per the following conditions:

- Payment of an initial option fee of AUD $20,000 (complete).

- Upon exercise of the Option Agreement (in the coming days): (1) AUD $50,000 cash; (2) AUD $50,000 of MTM Shares; and (3) a 2% net smelter royalty on all minerals obtained from the Project (1% of which may be re-purchased for AUD $1,000,000).

- On the first anniversary of the Option Agreement exercise: (1) AUD $100,000 cash; and (2) AUD $100,000 MTM Shares subject to shareholder approval or, failing shareholder approval being granted, the cash equivalent.

- On the second anniversary of the Option Agreement: (1) AUD $100,000 cash; and (2) AUD $100,000 MTM Shares subject to shareholder approval or, failing shareholder approval being granted, the cash equivalent.

- For the duration of the term of the Option Agreement, MTM must satisfy the following annual expenditure commitments on the Pomme Project to satisfy its earn-in conditions: (1) AUD $300,000 in the first year; (2) AUD $700,000 in the second year; and (3) AUD $1,000,000 in the third year.

Figure 1: Airborne magnetic image of the Pomme Project and Montviel Deposit.

“We are excited to see the transaction with Mt Monger Resources go through. Australian companies are attracted to both the potential of the greater Montviel carbonatite complex and the favorable mining jurisdiction that Quebec has to offer. Any potential discoveries at the Pomme project will be a favorable development to the Montviel project. Having additional deposits, infrastructure or development in the region will be a significant plus for the long-term development of Montviel for which we are currently conducting a hydrometallurgical test work program (see Feb 9, 2022 press release).” commented Kiril Mugerman, President & CEO of Geomega.

About Geomega (www.geomega.ca)

Geomega develops innovative technologies for extraction and separation of rare earth elements and other critical metals essential for a sustainable future. With a focus on renewable energies, vehicle electrification, automation and reduction in energy usage, rare earth magnets or neo-magnets (NdFeB) are at the center of all these technologies. Geomega’s strategy revolves around gradually de-risking its innovative technology and delivering cashflow and return value to shareholders while working directly with the main players in these industries to recycle the magnets that power all those technologies.

As its technologies are demonstrated on larger scales, Geomega is committed to work with major partners to help extract value from mining feeds, tailings and other industrial residues which contain rare earths and other critical metals. Irrespective of the metal or the source, Geomega adopts a consistent approach to reduce the environmental impact and to contribute to lowering greenhouse gases emissions through recycling the major reagents in the process.

Geomega’s process is based around its proprietary, low-cost, environmentally friendly way to tap into a C$1.5 billion global market to recycle magnet production waste and end of life magnets profitably and safely.

Geomega also owns the Montviel rare earth carbonatite deposit, the largest 43-101 bastnaesite resource estimate in North America and holds over 16.8M shares, representing approximately 13% of the issued and outstanding shares, of Kintavar Exploration Inc. (KTR.V), a mineral exploration company that is developing copper projects in Quebec, Canada.

For further information, please contact:

Kiril Mugerman

President and CEO

Geomega

450-641-5119 ext.5653

kmugerman@geomega.ca

Nancy Thompson

Vorticom Public Relations

212-532-2208

nancyt@vorticom.com

Twitter: @Geomega_REE

Cautions Regarding Forward-Looking Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains statements that may constitute “forward-looking information” or “forward-looking statements” within the meaning of applicable Canadian securities legislation. Forward-looking information and statements may include, among others, statements regarding future plans, costs, objectives or performance of the Corporation, or the assumptions underlying any of the foregoing. In this news release, words such as “may”, “would”, “could”, “will”, “likely”, “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate” “target” and similar words and the negative form thereof are used to identify forward-looking statements. Forward-looking statements should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether, or the times at or by which, such future performance will be achieved. No assurance can be given that any events anticipated by the forward-looking information will transpire or occur, including as regards the commercialization of any of the technology referred to above, or if any of them do so, what benefits the Corporation will derive. Forward-looking statements and information are based on information available at the time and/or management’s good-faith belief with respect to future events and are subject to known or unknown risks, uncertainties, assumptions and other unpredictable factors, many of which are beyond the Corporation’s control. These risks, uncertainties and assumptions include, but are not limited to, those described under “Risk Factors” in the Corporation’s annual management’s discussion and analysis for the fiscal year ended May 31, 2022, which is available on SEDAR at www.sedar.com; they could cause actual events or results to differ materially from those projected in any forward-looking statements. The Corporation does not intend, nor does the Corporation undertake any obligation, to update or revise any forward-looking information or statements contained in this news release to reflect subsequent information, events or circumstances or otherwise, except if required by applicable laws.